The Long-Term Impact of Podcast Advertising

One of the most unique factors that differentiate podcasting from other forms of advertising is the very long-tail of orders that it drives. In sharp contrast to the immediacy of a paid-search ad, podcasts can engender economic activity from the audience multiple weeks into the future. This phenomenon is a result of several factors.

- Customers have the freedom to download episodes whenever they want.

- Listening habits differ, and consumers will frequently save podcast episodes for specific events. I always download a few of my favorites if I plan on traveling.

- Many of the products advertised on podcasts can be expensive and require a substantial consideration cycle before purchase.

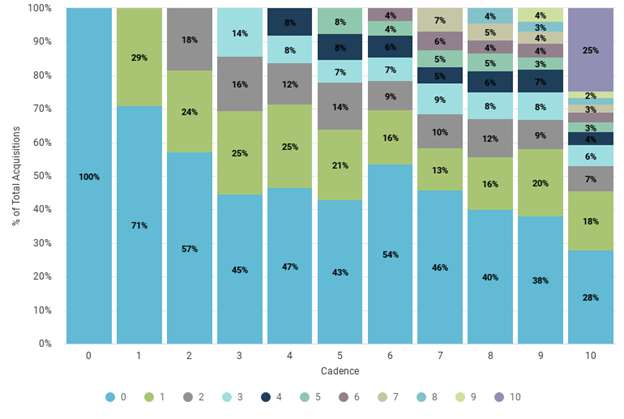

As the premier podcasting agency in America, Ad Results Media has invested substantial resources in understanding this phenomenon. A natural first step in understanding the impact these “drag” orders can have on client performance is getting a sense of their scale. The chart below is derived from our extensive database of client performance, spanning hundreds of millions of dollars of spend, over 100,000 spot placements, and billions of downloads.

Cadence on the X-axis indicates the number of weeks between airings of a show.

So 0 means no weeks off between airings, 1 means a single week, etc… The different stacked bars then show the percent of orders that came in the different weeks. Even with just 1 week between airings, 29% of the orders on average came after the first week. On a more typical schedule of 1 week on and 3 off, over half (55%) of the orders came after the first week.

Understanding the ‘Drag’ Effect in Podcasting

This immediately has a significant impact on understanding the performance of the ad spot. The first thing we always need to caution our clients against is that evaluating the financial performance of an ad after a single week after the spot drops (or even within the same week) is likely to be very noisy. Patience is a hard thing to argue for when millions of dollars are being spent, but in the case of podcasting, it is essential to good decision-making.

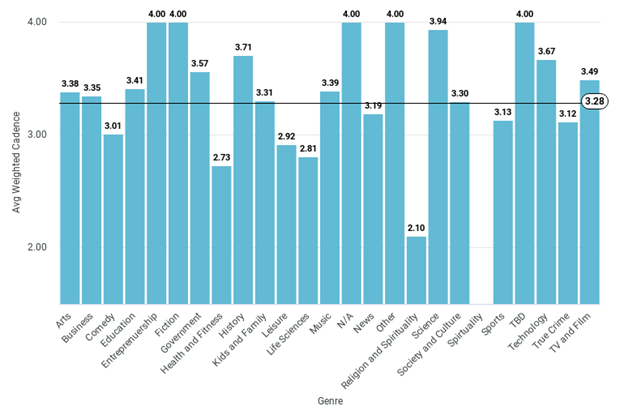

Another key fact that we have come to understand is that not all shows or genres exhibit the same type of drag. News, sports, and other more topical genres will generally have smaller drag effects, as listeners are less likely to reach into the back catalog for interesting things to listen to. Conversely, something like True Crime will remain engaging long after the spot drop date.

Optimizing Podcast Advertising for Maximum Performance

Using these insights, as well as understanding how well particular shows or genres are performing across our wide pool of clients, Ad Results has built a tool to estimate the optimal cadence for shows/genres and channels (seen below for Podcasting Genres).

This optimization is done by trading off the effects of drag, the performance of the underlying shows, and the opportunity cost of not advertising on top-performers.

This insight allows us to set schedules to maximize performance for clients, and we consider this to be one of our core competitive advantages. Ad Results has been doing this longer than anyone else, so we know more, have a bigger dataset, and can use that to maximize results for our clients.